Coming into tax compliance with the IRS is crucial for U.S. persons residing in the United States who have offshore accounts. One avenue that allows taxpayers to rectify their reporting obligations is through the Streamlined Domestic Offshore Procedures. This article aims to provide a comprehensive guide to IRS Form 14654 Certification, a critical component of the streamlined process.

Certification by U.S. Person Residing in the U.S. - Form 14654:

Form 14654 is an essential document that taxpayers must complete as part of the Streamlined Domestic Offshore Procedures. The form requires individuals to certify that their failure to report all income, pay all tax, and submit all required information returns, including Foreign Bank and Financial Accounts (FBARs), was due to non-willful conduct. Here is a breakdown of the different sections of the form:

Contact Castro & Co. online or by calling (833) 227-8761 for a free consultation

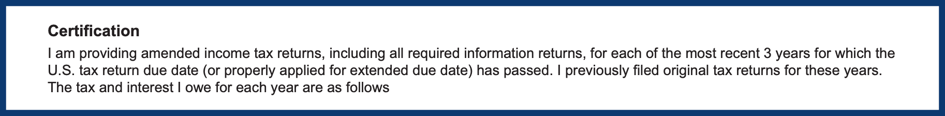

Section 1 - Certification Statement:

Taxpayers acknowledge that they missed reporting income on their original tax returns and provide a summary of the taxes due for the most recent three years.

Section 2 - 3-Years of Tax Liability:

A section where taxpayers summarize the taxes owed, including the tax year, amount of tax due, interest, and total.

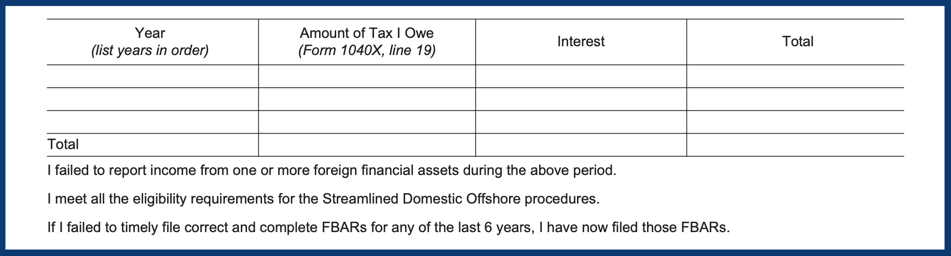

Section 3 - Assets Subject to Penalty:

Taxpayers list the assets subject to the 5% penalty, excluding certain assets like personal real estate investments.

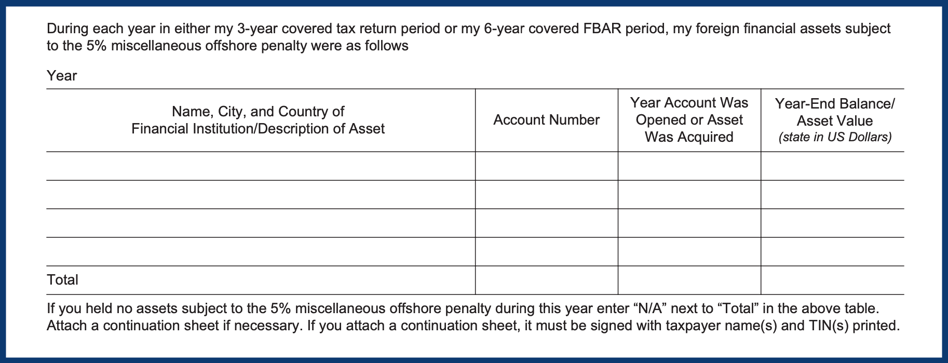

Section 4 - Computing the Penalty:

An explanation of how the penalty is calculated, including an example of the Title 26 Miscellaneous Offshore Penalty calculation.

Section 5 - 5% Penalty Limitation:

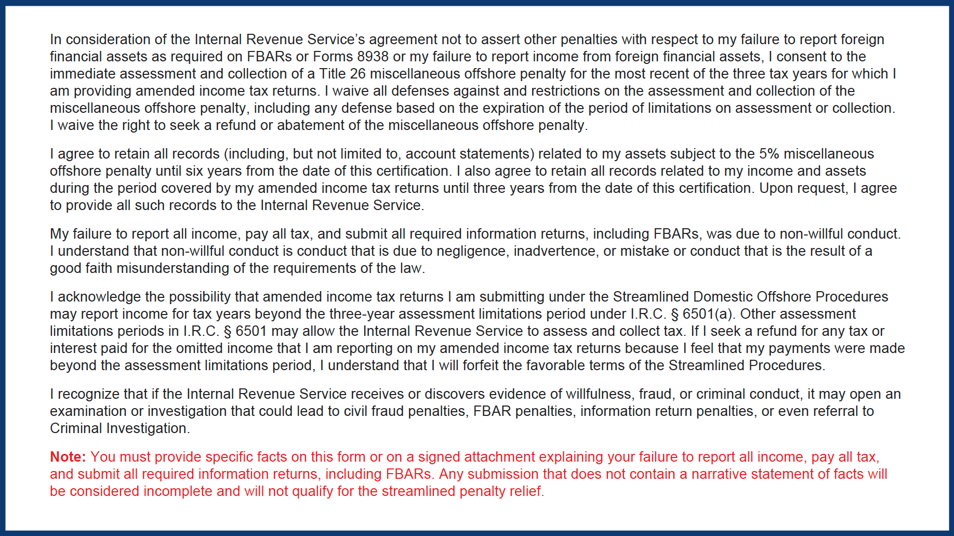

Taxpayers agree to pay a single-year 5% penalty in lieu of other offshore penalties, waiving certain rights and agreeing to retain records.

Section 6 - Non-Willful Certification Statement:

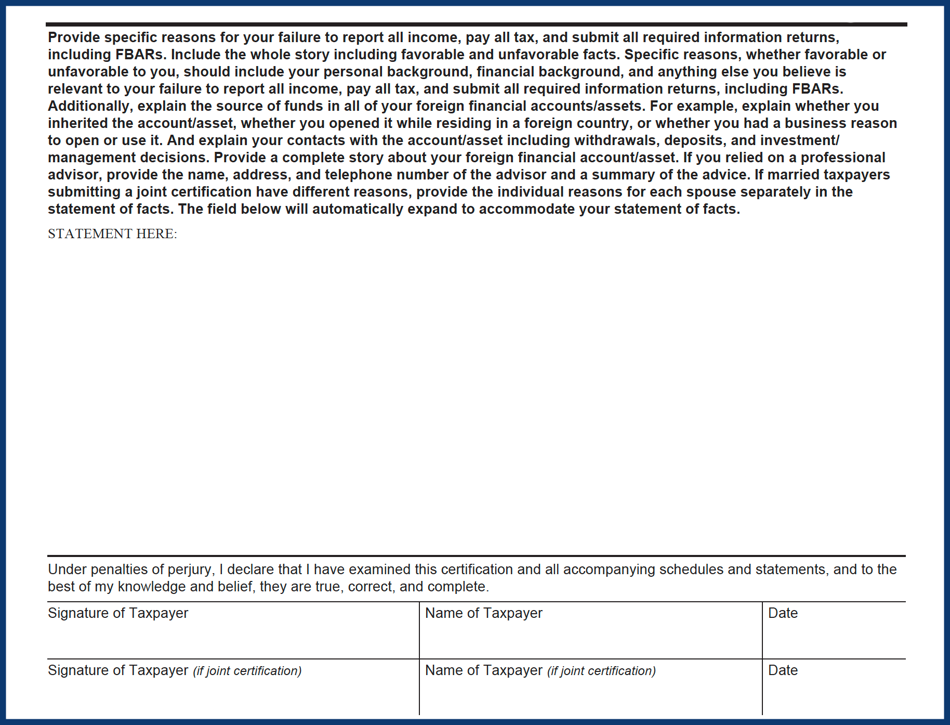

Taxpayers must submit a statement under penalty of perjury explaining their non-willful conduct, including specific facts and circumstances.

Tips and Considerations:

Crafting a concise and focused non-willful certification statement that includes all necessary information.

Maintaining a respectful and cooperative approach when interacting with IRS agents.

Double-checking the form instructions to ensure compliance with the program requirements.

Understanding the significance of signing the form under penalty of perjury.

Conclusion:

Taking action to come into tax compliance with the IRS is a crucial step for U.S. persons residing in the United States with offshore accounts. Understanding and completing IRS Form 14654 Certification is an integral part of the Streamlined Domestic Offshore Procedures. By following the guidelines and providing accurate information, taxpayers can rectify their reporting obligations and avoid more severe penalties in the future.

Remember, while this article provides an overview of Form 14654, it is advisable to seek professional advice from a tax expert or attorney experienced in offshore compliance to ensure a thorough and accurate submission.

Disclaimer: This article is intended for informational purposes only and should not be construed as legal or tax advice. Please consult with a qualified professional for personalized guidance based on your specific circumstances.

Contact Castro & Co. online or by calling (833) 227-8761 for a free consultation