The opportunity for taxpayers to deduct personal casualty losses has been significantly limited following the enactment of the Tax Cuts and Jobs Act (TCJA). Under the new rules that apply for tax years 2018 - 2025, individuals can only claim deductions for casualty and theft losses related to personal assets if the losses occur within a federally declared disaster area.

There are two key elements to the new rules. First, deductible losses do not have to be situated within the precise boundaries of the disaster area; losses can still be claimed if they are attributed to a federally declared disaster within the taxpayer’s state. As you can imagine, the full scope of this is subject to legal interpretation, which means the better tax attorney you have, the more you can deduct. Secondly, taxpayers are not deemed to have sustained a loss until the amount of any other recovery, such as insurance reimbursement, is determined. If the full scope of a loss is not realized until later, you can amend a prior-year return to claim the full loss. Again, this is why having qualified tax counsel is viewed by the wealthy as an investment with a return.

Deducting Disaster Losses

It is important to note that only losses directly associated with federally declared disasters are eligible for deductions. Such disasters are those declared by the President and designated for federal assistance under the Robert T. Stafford Disaster Relief and Emergency Assistance Act. This includes major disasters or emergencies as defined by the Act. Even if a taxpayer’s property is not located within a designated county, the deduction can still be claimed as long as the loss is attributable to the federally declared disaster within the taxpayer’s state.

When to Claim Disaster Tax Relief

Regarding the timing of deductions, casualty losses are generally deductible in the year the loss is sustained, which typically corresponds to the year in which the casualty occurred. However, under the TCJA rules, taxpayers who experience a casualty loss from a federally declared disaster have the option to deduct the loss in the year it occurred or in the preceding tax year. Taxpayers can file amended returns for the preceding year if necessary. Basically, to expedite relief, you can claim it right away; there’s no need to wait until the close of the tax year to claim it next year.

You Can Only Claim Amounts Not Expected to be Covered

It is crucial to consider that if there is a reasonable prospect of recovery, a loss cannot be deducted until it is reasonably certain whether the taxpayer will receive reimbursement. The loss is not considered to be sustained until this certainty is established. As an example, if a taxpayer experiences a flood on May 1, 2017, but has a claim for reimbursement with a reasonable prospect of recovery, the loss is not sustained until it can be ascertained with reasonable certainty whether reimbursement will be received. Only then can the casualty loss be claimed. If the loss is treated as occurring in a year that was not within a federally declared disaster area, it is not deductible.

There are specific dollar limits applicable to casualty loss deductions. Losses covered by insurance are not deductible, and taxpayers must file an insurance claim to determine the deductible amount. The deductible portion is the amount not covered by insurance. Two distinct dollar limits come into play: the first $100 of loss per casualty is not deductible, and the deduction is limited to losses exceeding 10% of the taxpayer's adjusted gross income (AGI). It is worth noting that these restrictions do not apply to business casualty losses, which were preserved by the TCJA.

The Full Scope of the Casualty Deduction

The IRS defines a casualty loss as damage, destruction, or loss of property resulting from any sudden, unexpected, or unusual event, such as a flood, hurricane, tornado, fire, earthquake, or volcanic eruption. It is important to distinguish a casualty from normal wear and tear or progressive deterioration. Again, this is where having a good contingent tax attorney is worth it.

In the world of tax planning, not having a tax attorney is going to cost you more than you realize. The vast majority of Americans simply don’t know how to fully leverage all of the benefits under the law. Be smart and schedule a free consultation.

The Castro Enhanced Casualty Loss Deduction for Disaster Areas

Our firm has a unique interpretation of the law and regulations that can increase the value of the deduction by up to 300%. Three times the tax savings; three times the size of the refund.

Contact Our Firm

Contact our firm today to schedule a free consultation by clicking here to submit your information online and be contacted by our firm.

Legal Disclosure

This article is not intended to be relied on for the purpose of establishing reasonable cause, good faith, or avoiding tax-related penalties under the Internal Revenue Code. The requirements for written legal advice to establish reasonable cause for the avoidance of penalties are outlined in 31 C.F.R. § 10.37. It is improper and impermissible to rely on this article as legal advice. In the U.S. tax system, generally, only a paid consultation or formal written tax opinion can be used as an affirmative defense to penalties. Free consultations may not be relied upon as legal advice for the purpose of avoiding penalties. The objective of a free consultation is to determine the client’s issue, fact pattern, and whether the firm can provide a legally viable solution with a minimum of Substantial Authority to support it. If you require formal legal advice upon which you can legally rely to establish reasonable cause, please contact our firm.

Key Words and Phrases

IRS Form 4684 is for Casualties and Thefts. This is commonly known as a Casualty Loss. If you’re in need of IRS Disaster Relief, the Casualty Loss Deduction can help. A Disaster Loss Deduction is the government’s way of providing Disaster Tax Relief. Think of it as a Disaster Loss Deduction. If you suffered from a hurricane, it’s Hurricane Tax Relief. If you suffered from a tornado, it’s Tornado Tax Relief.

Confidence Level Disclosure

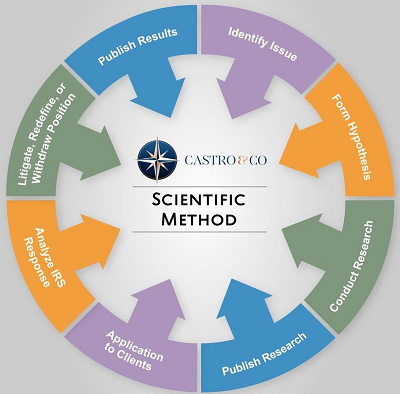

For over 3600 years, the scientific method has been used by innovative individuals as an empirical method of acquiring knowledge. In the world of tax law, it is no different. In some cases, we offer free consultations to identify the issue, form a hypothesis, conduct legal research to work toward developing a possible solution, publish our research, apply the legal theory to a client’s real-world situation, analyze the administrative response from the IRS, and then decide whether to litigate, redefine, or withdraw the position.

If the IRS points out something we had previously not considered and the legal position cannot be redefined to cure the issue, then we would withdraw the position and issue a notice to any clients to whom it applied. If, however, the position can be cured by redefining the position, then we will do so assuming the clients’ facts support the redefinition. This would, of course, entail contacting the client to seek clarification. If, however, we do not agree with the IRS response, then we will pursue litigation to seek judicial clarification in our favor.

The Scientific Method helps our tax system mature, develop, and improve by asking new questions and developing new interpretations of our tax code, answering previously unanswered questions, testing these legal theories in the federal judiciary, and eliminating ambiguity through judicial clarification. Judicial clarification even helps eliminate the need of tax attorneys who financially benefit from legal ambiguity. A fair and balanced tax system is one that is clear and concise with zero ambiguity. This can only be achieved through judicial clarification.

In the U.S. legal system, the "strength" of a legal interpretation can be quantified based on the amount of legal support for the interpretation. While a portion of this quantification is certainly subjective based on the reviewer’s legal interpretative philosophy, it is indisputable that a quantified range that encompasses all interpretative philosophies can be established. In some cases, this range can vary wildly. The importance of the level of legal authority is that it determines when penalties will and will not apply as well as when disclosure is and is not required to avoid said penalties. The range of levels of legal confidences are, from weakest to strongest, Reasonable Basis, Substantial Authority, More Likely Than Not, Should, and Will. In actual practice, a “Will” level opinion is never sought out by taxpayers since that would simply be a reiteration of basic textbook principles of the tax code. Likewise, a “Reasonable Basis” level opinion is rarely issued since, absent a compelling political or social purpose, it is highly unlikely to prevail in court. If, however, the topic of the “Reasonable Basis” opinion implicates a compelling political or social issue, such as the deduction for child care expenses, then our confidence in our ability to sway the federal judiciary increases, and we are, therefore, much more confident in asserting said legal position before the federal judiciary. This leaves only three confidence levels: Substantial Authority, More Likely Than Not, and Should. These are the three confidence levels within which our firm primarily operates.

A “Substantial Authority” opinion means that, if contested by the Service, the position advanced has a 35 percent to 49 percent chance of succeeding on the merits. A “More Likely Than Not” opinion means that, if contested by the Service, the position advanced has a greater than 50 percent chance of succeeding on the merits. A “Should” opinion, which is the threshold of opinion expressed in this letter, generally means that, if contested by the Service, the position advanced has a chance greater than 70 percent of success on the merits. It is important to note that these quantifications themselves are hotly contested, which implicates “void of vagueness” concerns.

The confidence level of the legal interpretation expressed in this article is: More Likely Than Not.

Bluebook Citation

IRS Disaster Relief Using IRS Form 4684 to Claim a Casualty Loss Deduction, Int’l Tax Online Law Journal (June 26, 2023) url.

Legal Citations