Introduction

There was once a time when everyone thought the world was flat.

This is a phrase we often repeat to clients. Today, the prevailing opinion among tax firms, CPAs, and attorneys is that foreign residential real estate must be depreciated over a 40-year period; here, here, here, and here. This is incorrect. Allow us to educate and illuminate.

These so-called tax professionals are referring to Internal Revenue Code section 168(g)(1)(A), which states “In the case of any tangible property which during the taxable year is used predominantly outside the United States the depreciation deduction provided by section 167(a) shall be determined under the alternative depreciation system.”

That sounds mandatory, but, as the U.S. Supreme Court explained in Martinez v. Lamagno, the term "shall" is permissive when used in statutes passed by Congress absent language further indicating it is compulsory. But let’s pause on that issue for a moment; we’ll come back to it.

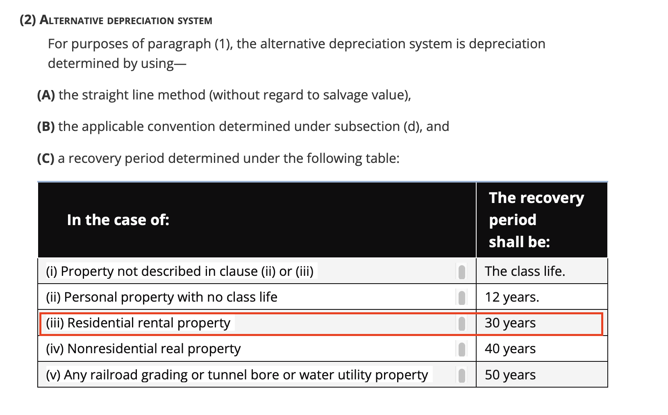

Let’s assume it is mandatory. All of the so-called experts are still wrong. Assuming it is subject to the “alternative depreciation system,” under Code section 168(g)(2)(C)(iii), “residential rental property” is depreciable over 30 years; not 40 years. Here's a snapshot of the actual statute:

Now that you know for certain the so-called experts didn’t even get the depreciable life of foreign rental property correct, we move back to Code section 168(g)(1)(A).

In Martinez v. Lamagno, the United States Supreme Court, in a 5-4 decision, explained that courts “in virtually every English-speaking jurisdiction have held, by necessity, that shall means may in some contexts, and vice versa.” As such, shall should not be interpreted as being compulsory. The Court further elaborated in finding that “shall and may are frequently treated as synonyms.” Gutierrez de Martinez v. Lamagno, 515 U.S. 417 (1995).

Possible Responses

So there you have it. Possible responses from your inept tax professional:

- “The U.S. Supreme Court is wrong.” Let me tell you why this is wrong. The United States Supreme Court is the final say on what the law is. Their decisions are the supreme law of the land. You may disagree, but it’s the law. Its equivalent to disagreeing with gravity. If your tax professional uses this argument, run for the hills. You have a tax professional so arrogant and unwilling to admit a mistake that he’ll take you down with him. You’ve been warned.

- “Shall is definitely mandatory in the context of Code section 168(g)(1)(A).” Let me tell you why this is wrong. No court in the United States has ever ruled that “shall” in this Code provision is mandatory. The IRS certainly thinks it’s mandatory. See Rev. Rul. 1990-9; Rev. Proc. 90-10; PLR 8835009. But ask yourself, does the tax professional work for you or the IRS? Unlike other firms, we know who our client is, and, if the IRS disagrees with our position, we’ll sue them in federal court and make our case before a judge. It’s kind of difficult for a judge to say he disagrees with the U.S. Supreme Court without risking impeachment and removal from judicial office. Unlike other firms, we stand our ground.

- “Castro & Co doesn’t know what they’re talking about” and other ad hominem personal attacks. Let me tell you why this is wrong: empty barrels make the most noise. They don’t know how to respond with knowledge and intellect, so they resort to personal attacks and do their best to convince you their attacks are valid. Just thank them for their service and ask for your tax files so you can come to our firm. We know the law.

Contact Our Firm

Our firm offers free, no-cost, no obligation consultations. Contact our firm to schedule a free consultation by clicking here and submitting your information.