Executive Summary

A Passive Foreign Investment Company (“PFIC”) is defined in Section 1297 to be any foreign corporation, the gross income of which is 75% or more passive income or if 50% or more of its assets are used to produce passive income or held for the production of passive income. Basically, a foreign corporation with either (a) 75% or more passive income or (b) 50% or more passive assets.

The prevailing wisdom is that all offshore investment companies are PFICs since all distributions to the investors are passive income. But is that true?

Section 1297(b)(1) defines the term passive income by referencing Section 954(c). In turn, Section 954(c) defines “foreign person holding company income” with an emphasis on whether the income is passive at the entity-level; not the investor level. This is illustrated by the dealer exception in Section 954(c)(2)(C). This exception effectively creates a loophole for “Active Foreign Investment Companies.” In other words, offshore hedge funds that materially participate are exempt from the PFIC designation.

Consider this: since Section 1297’s enactment in 1986, there has not been a single court case providing substantive guidance. In fact, only recently in 2021 did Treasury finally promulgate regulations. Even with these new regulations, there is limited guidance since Treasury continues to employ the use of Strategic Ambiguity to keep the law unconstitutionally vague.

Nevertheless, even the new regulations support the interpretation that there is an exception for Active Foreign Investment Companies. See Treas. Reg. § 1.1297-1(d)(5).

Due to the highly sensitive nature of this article, any further discussion should be in the context of a privileged consultation. We engage clients on a purely contingent basis to pursue refund claims of refund from the IRS with free audit and even in-court legal defense.

Contact Our Firm

Contact our firm today to schedule a free consultation by clicking here. After you submit your information, you will be contacted by our firm.

Legal Disclosure

This article is not intended to be relied on for the purpose of establishing reasonable cause, good faith, or avoiding tax-related penalties under the Internal Revenue Code. The requirements for written legal advice to establish reasonable cause for the avoidance of penalties are outlined in 31 C.F.R. § 10.37. It is improper and impermissible to rely on this article as legal advice. In the U.S. tax system, generally, only a paid consultation or formal written tax opinion can be used as an affirmative defense to penalties. Free consultations may not be relied upon as legal advice for the purpose of avoiding penalties. The objective of a free consultation is to determine the client’s issue, fact pattern, and whether the firm can provide a legally viable solution with a minimum of Substantial Authority to support it. If you require formal legal advice upon which you can legally rely to establish reasonable cause, please contact our firm.

Confidence Level Disclosure

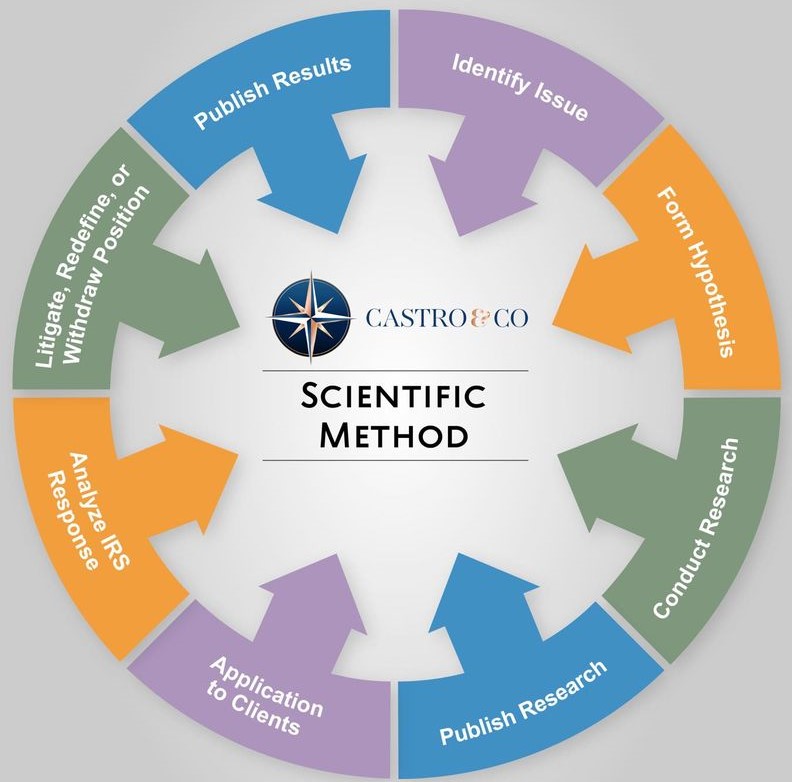

For over 3600 years, the scientific method has been used by innovative individuals as an empirical method of acquiring knowledge. In the world of tax law, it is no different. In some cases, we offer free consultations to identify the issue, form a hypothesis, conduct legal research to work toward developing a possible solution, publish our research, apply the legal theory to a client’s real-world situation, analyze the administrative response from the IRS, and then decide whether to litigate, redefine, or withdraw the position.

If the IRS points out something we had previously not considered and the legal position cannot be redefined to cure the issue, then we would withdraw the position and issue a notice to any clients to whom it applied. If, however, the position can be cured by redefining the position, then we will do so assuming the clients’ facts support the redefinition. This would, of course, entail contacting the client to seek clarification. If, however, we do not agree with the IRS response, then we will pursue litigation to seek judicial clarification in our favor.

The Scientific Method helps our tax system mature, develop, and improve by asking new questions and developing new interpretations of our tax code, answering previously unanswered questions, testing these legal theories in the federal judiciary, and eliminating ambiguity through judicial clarification. Judicial clarification even helps eliminate the need of tax attorneys who financially benefit from legal ambiguity. A fair and balanced tax system is one that is clear and concise with zero ambiguity. This can only be achieved through judicial clarification.

In the U.S. legal system, the "strength" of a legal interpretation can be quantified based on the amount of legal support for the interpretation. While a portion of this quantification is certainly subjective based on the reviewer’s legal interpretative philosophy, it is indisputable that a quantified range that encompasses all interpretative philosophies can be established. In some cases, this range can vary wildly. The importance of the level of legal authority is that it determines when penalties will and will not apply as well as when disclosure is and is not required to avoid said penalties. The range of levels of legal confidences are, from weakest to strongest, Reasonable Basis, Substantial Authority, More Likely Than Not, Should, and Will. In actual practice, a “Will” level opinion is never sought out by taxpayers since that would simply be a reiteration of basic textbook principles of the tax code. Likewise, a “Reasonable Basis” level opinion is rarely issued since, absent a compelling political or social purpose, it is highly unlikely to prevail in court. If, however, the topic of the “Reasonable Basis” opinion implicates a compelling political or social issue, such as the deduction for child care expenses, then our confidence in our ability to sway the federal judiciary increases, and we are, therefore, much more confident in asserting said legal position before the federal judiciary. This leaves only three confidence levels: Substantial Authority, More Likely Than Not, and Should. These are the three confidence levels within which our firm primarily operates.

A “Substantial Authority” opinion means that, if contested by the Service, the position advanced has a 35 percent to 49 percent chance of succeeding on the merits. A “More Likely Than Not” opinion means that, if contested by the Service, the position advanced has a greater than 50 percent chance of succeeding on the merits. A “Should” opinion, which is the threshold of opinion expressed in this letter, generally means that, if contested by the Service, the position advanced has a chance greater than 70 percent of success on the merits. It is important to note that these quantifications themselves are hotly contested, which implicates “void of vagueness” concerns.

The confidence level of the legal interpretation expressed in this article is: More Likely Than Not.

Bluebook Citation

The PFIC Loophole the IRS Doesn’t Want You to Know About, Int’l Tax Online Law Journal (October 12, 2022) url.