The IRS does not have official exchange rates. For the convenience of taxpayers, however, the U.S. Department of the Treasury publishes averaged-out exchange rates of particular currencies and tax years.

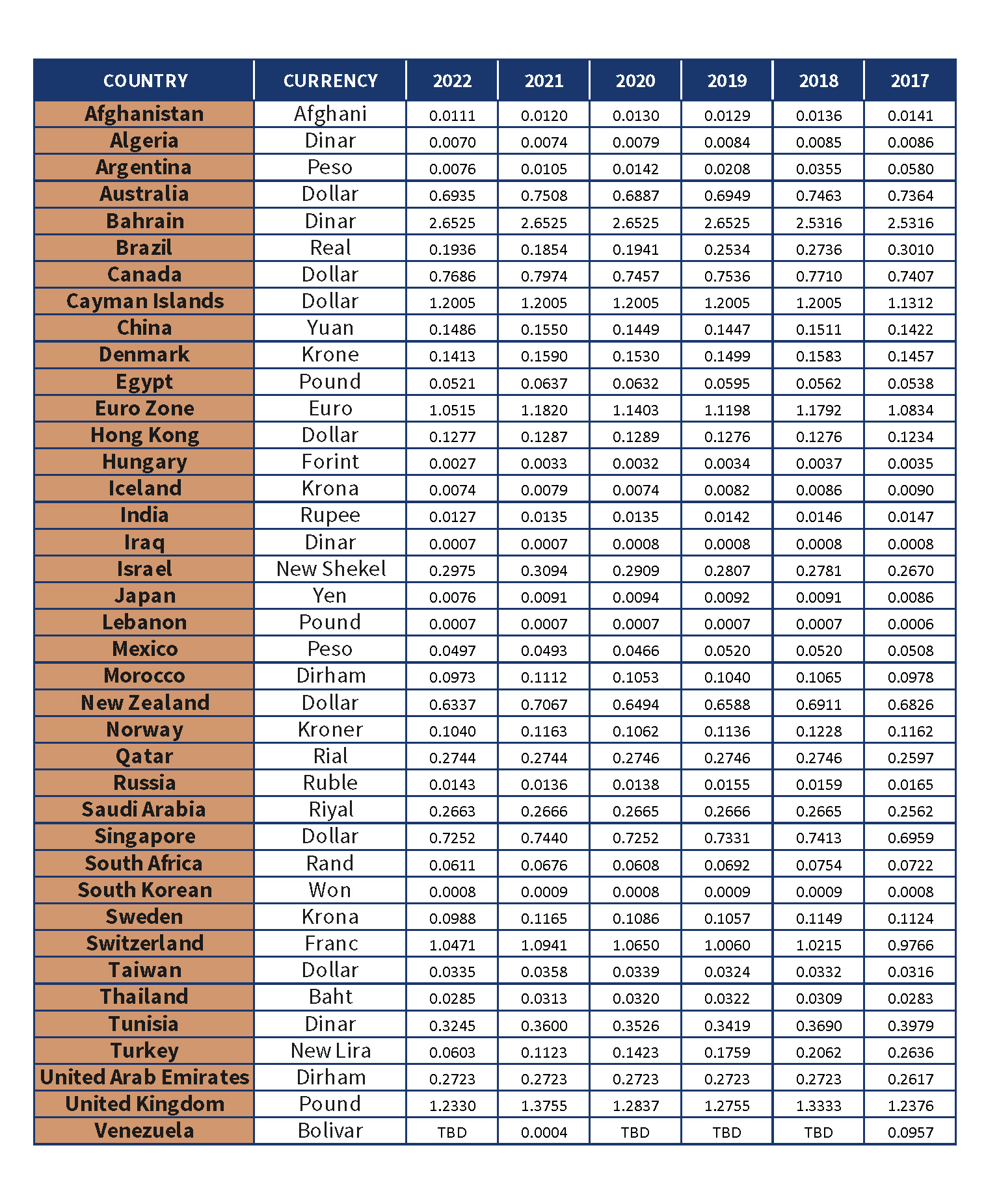

Below are the safe harbor exchange rates published by the U.S. Department of the Treasury for use in the preparation of U.S. federal income tax returns. For your convenience, we have provided the direct conversion rates from 1 foreign currency to USD. In other words, simply multiply the foreign currency by the applicable rate below to convert to U.S. dollars.

For “spot rates” on specific dates, use this calculator:

For economically unstable areas where there is a more accurate black market rate, such as Venezuela, label it the “free market rate.” Treas. Reg. § 1.988-1(d)(4)(i).